Skip the Bank. Get $100K–$250K in 0% Interest Business Funding—Fast.

Pre-Qualified in 48 Hours with Our Proven Funding Success Formula™

🎥 Watch How We’ve Helped Entrepreneurs Unlock Millions in Business Growth Capital!

What You Gain Access To

💳 Business Credit Lines

📄 Term Loans

💰 0% Interest Credit Cards

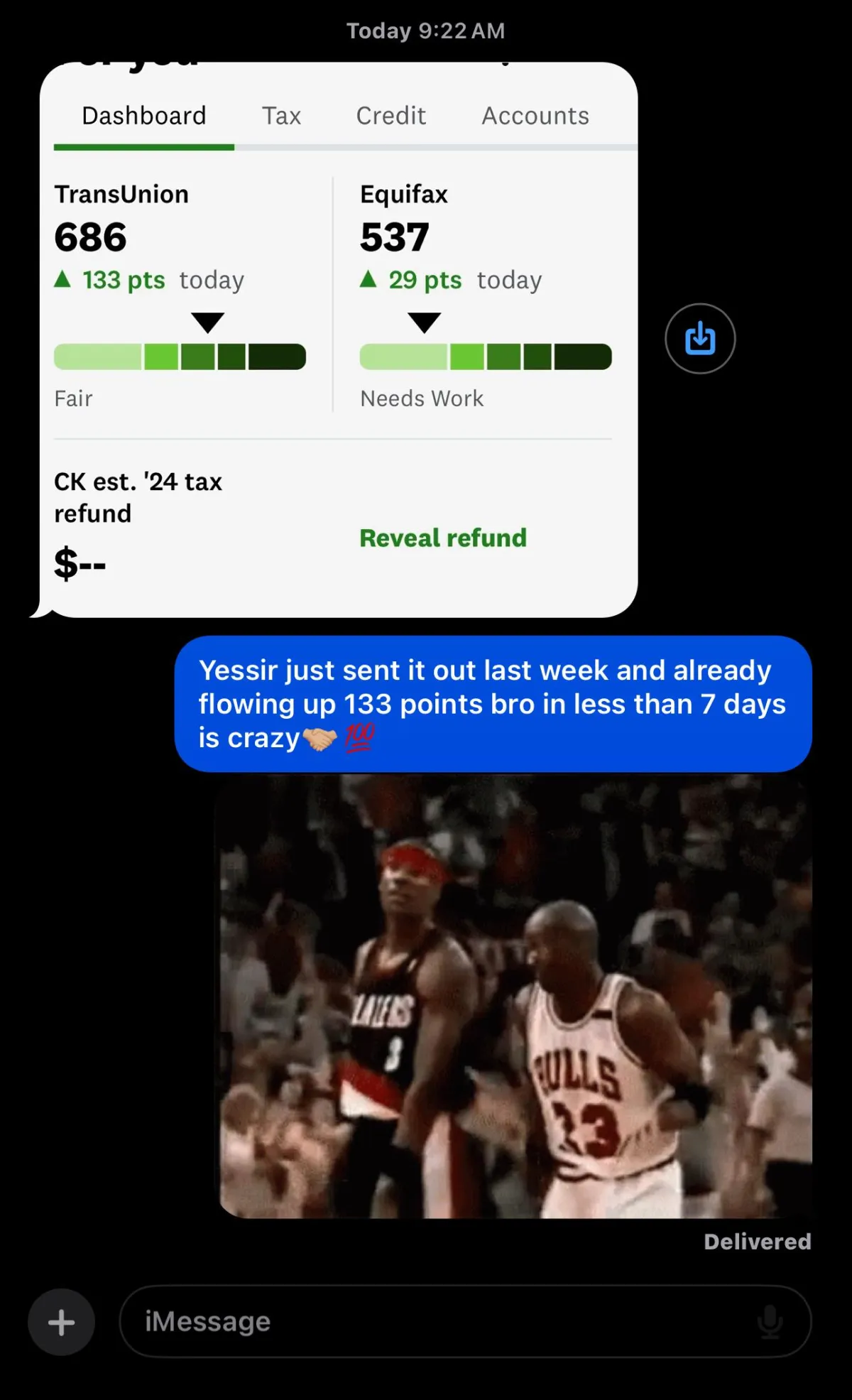

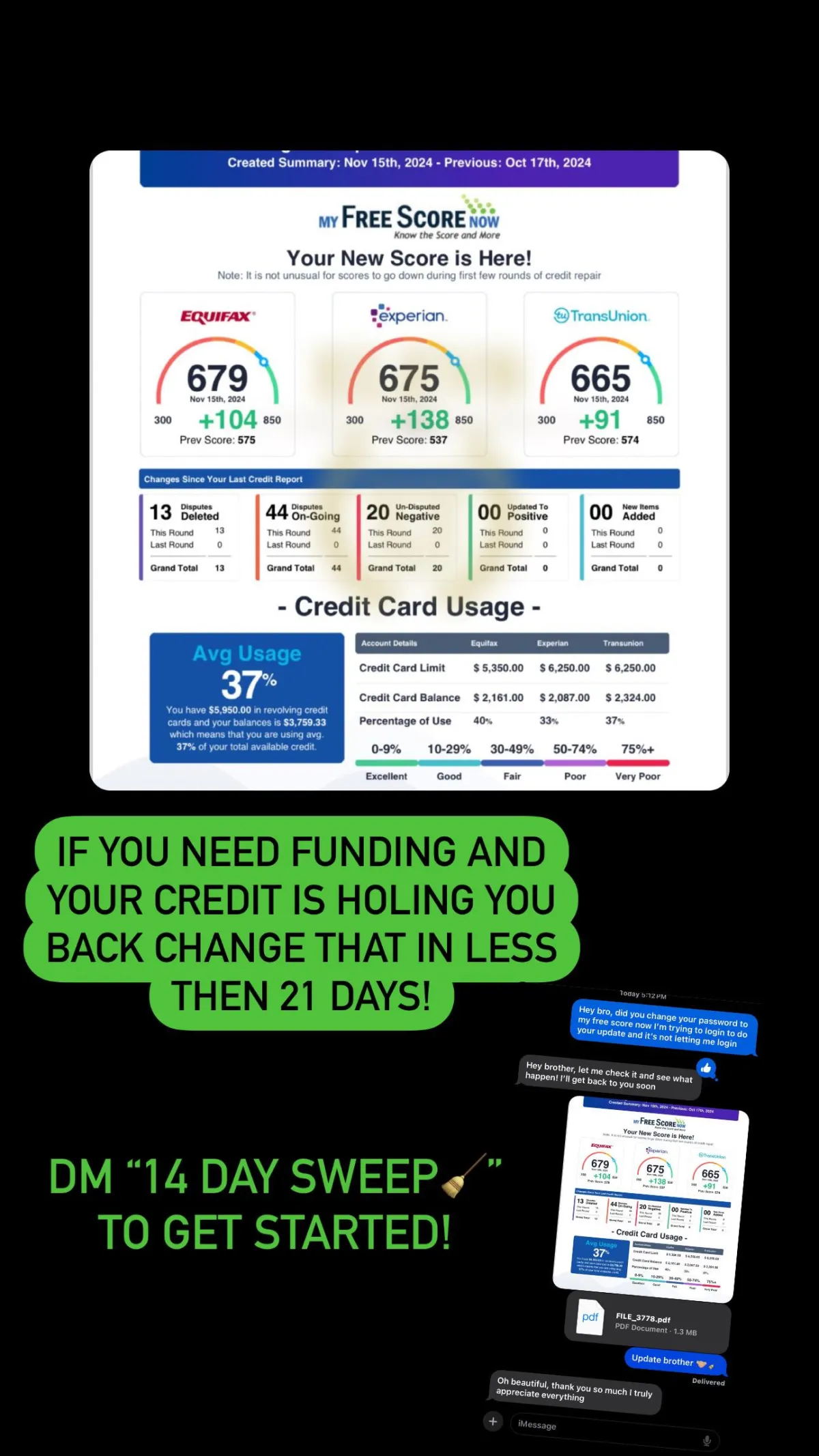

📈 Credit Score Optimization

🤝 Personal Loans & Lines of Credit

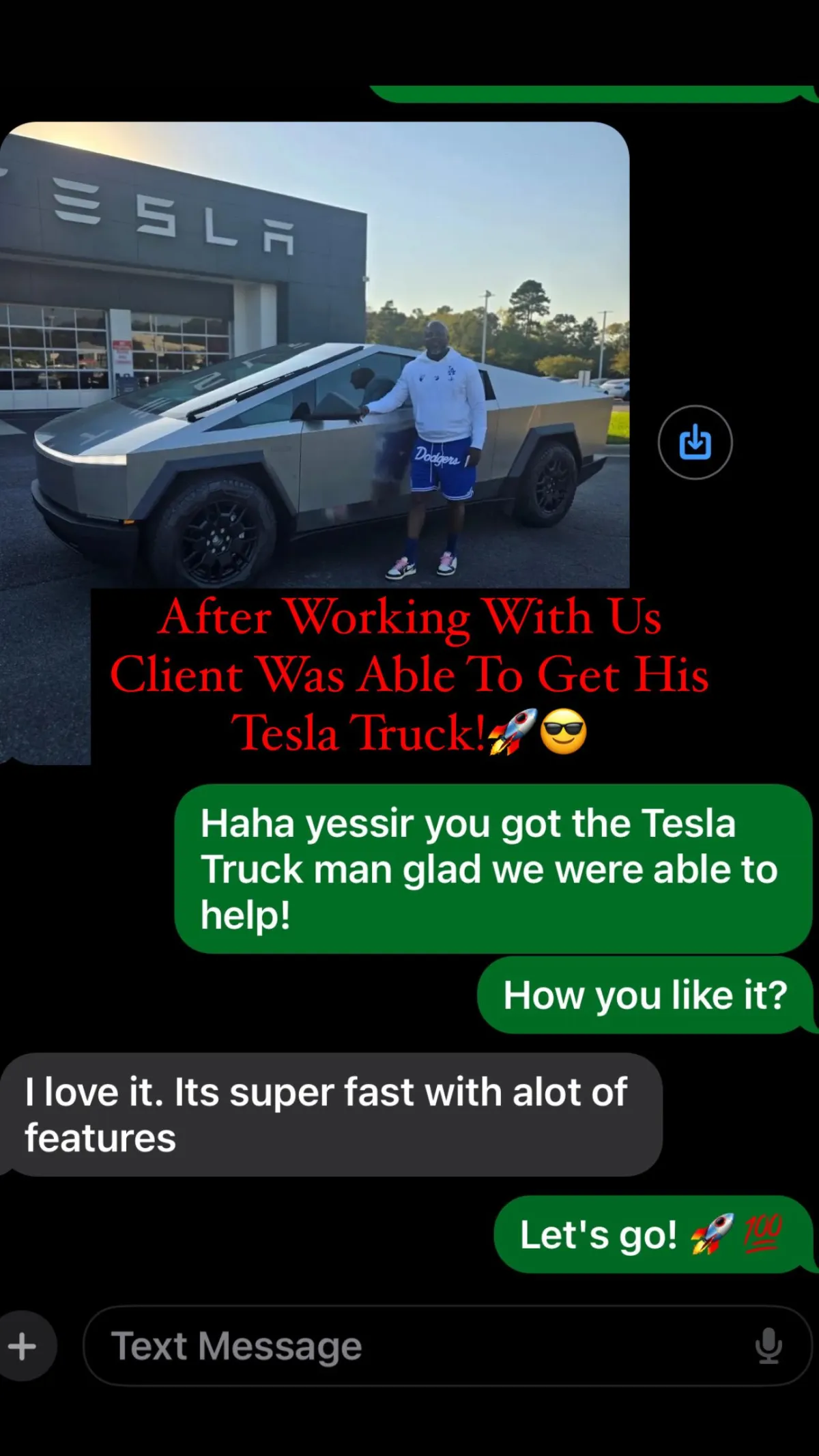

Don’t Take Our Word for It…

See What Our Clients Are Saying!

Real Stories. Real Success. Real Results.

Our 3 Step Funding Process to Cashflow

Fill Out the 5 Minute Quick Application

Get Funded

In As Little As 48Hrs

Invest & Cashflow

About us

Founded by Colton Williams, Elev8 University was created to bridge the gap between financial knowledge and actionable steps that lead to real, lasting change.

What started as a vision to educate and empower has grown into a comprehensive service platform dedicated to transforming credit health and unlocking funding opportunities.

Apply for Funding NowGet Pre-Approved in 5-Minutes

Today, we’re proud to support clients nationwide with both personal and business funding, all rooted in transparent, hands-on guidance.

How We Help: Your Path to Financial Growth

At Elev8 University, we provide more than just funding—we deliver tailored strategies, expert guidance, and ongoing support to help you achieve your financial and business goals. Here’s how we make it happen:

Personalized Funding Solutions

We take the time to understand your specific needs, whether you're starting a business, scaling operations, or improving your personal financial standing.

Business Funding: From credit lines to term loans, we customize solutions to fuel your growth.

Personal Funding: Access personal loans, credit optimization, and tailored strategies to build a strong financial foundation.

Credit Score Optimization

Your credit health matters, and we’re here to help you improve it.

Customized Plans: We analyze your credit and create actionable steps to boost your score.

Long-Term Benefits: Better credit means access to more favorable funding options in the future.

Your Success is Guaranteed

At Elev8, we don’t just promise results—we guarantee them:

100% Funding Guarantee

FREE No-Risk Consultation

VIP Ongoing Support

Lightning-Fast Approvals

Join Our Business Funding Family:

Ongoing Support Beyond Just Capital

We’re committed to your long-term success helping you secure funding, boost cash flow, and drive consistent business growth.

You’re part of the family, and we’re with you every step of the way!

Don’t Let Lack of Capital Hold You Back. Let’s Elev8 Your Potential!

Your success starts here. Let’s Elev8 your journey!

GOT QUESTIONS? LET'S ANSWER THEM!

Frequently Asked Questions

What is the minimum and maximum amount of funding I can apply for?

We offer funding amounts ranging from $10,000 to $1,000,000 based on your business’s needs and credit standing.

How long does it take to get approved?

Most approvals happen within 48 hours, but timelines may vary depending on your situation.

What are the interest rates and repayment terms?

Rates and terms vary based on the funding option you choose, but we always offer competitive terms.

Do I need to provide collateral for the funding?

It depends on the type of funding. Some options require collateral, while others do not.

What can I use the funding for?

You can use the funds for anything related to business needs—expansion, payroll, equipment, marketing, and more.

What kind of support can I expect after receiving funding?

We provide ongoing financial coaching and expert advice to help you manage your capital and grow your business.